Hey Communication Majors, it’s time to put all those communication skills you’ve learned to work. In an effort to help students pay off their average $26,000 debt, MassMutual is awarding $20,000 to the person who writes the most creative tweet about how they plan to reduce their debt.

Hey Communication Majors, it’s time to put all those communication skills you’ve learned to work. In an effort to help students pay off their average $26,000 debt, MassMutual is awarding $20,000 to the person who writes the most creative tweet about how they plan to reduce their debt.

The contest is simple. You’ll just need to like MassMutual’s “Down With Debt” Facebook page and write your 140 characters before February 14th.

“MassMutual recognizes that new graduates and young professionals in today’s world face big financial challenges,” said Tara Reynolds, MassMutual’s corporate vice president. “As a result, we created ‘Down with Debt’ to help people learn about effective ways to conquer their loans and take smart first steps in building a secure financial future.”

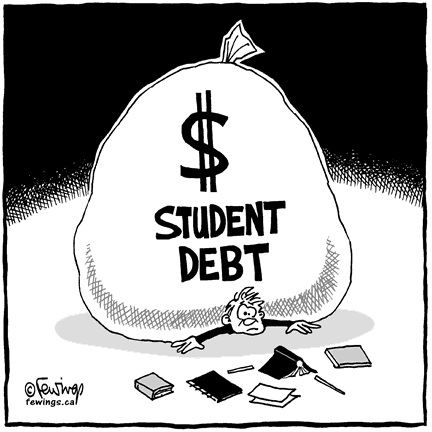

Because the national student debt totals one trillion dollars and MassMutual wants to use their Facebook page not only for the contest, but to help teach America’s youth about responsible money management, people can also visit their page to learn more about financial responsibility.

If you think you have what it takes to write a creative tweet, then get out your pen and paper, computer, voice recorder or whatever you use and start brainstorming. It may be a way to lift a $20,000 weight off your chest.

If you’re in need of some Twitter tips, here is a recent article we wrote on writing Tweets.

Good luck. We’re rooting for you.

Man once ran down in debt has everyone wanting to follow up!

First, I would set a realistic budget focused on better choices starting with cutting up and throw out your credit cards and start utilizing cash often, purchase the smallest cup of coffee instead of the bulk refill, eat a kids meal instead of the grand platter, teaching others the same awareness will lessen the daily stress and bring more happy conversations to the dinner table and commit to increasing my financial commitment to my church. Share the knowledge of my journey with local colleges and potentially publish a book of the process before, during and after attending college. Doing so will encourage others to truly think about what debt means to each and every one of them and it’s up to them to delve into their financial well-being.